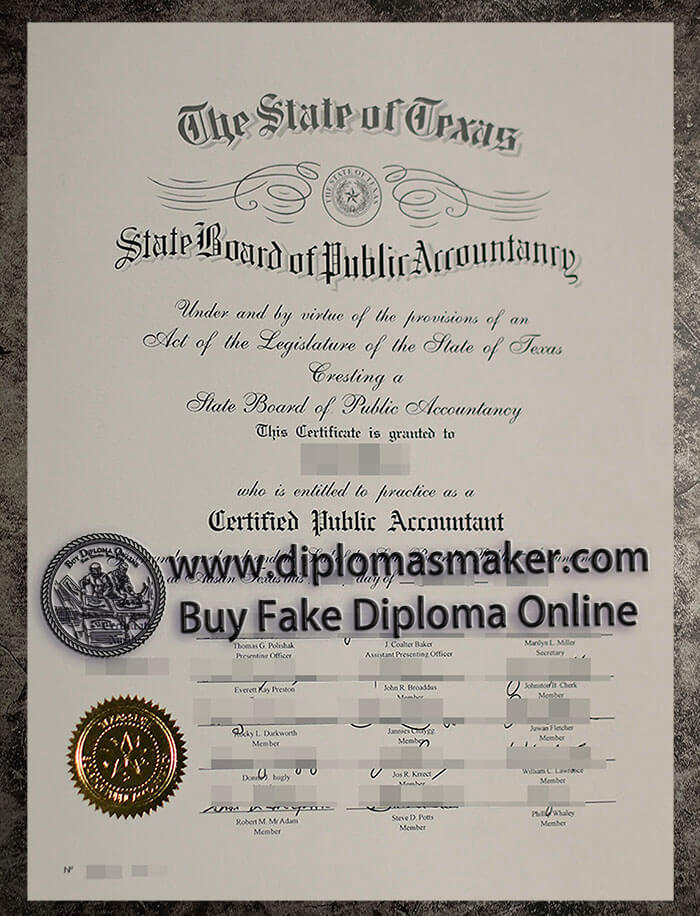

Where to order fake State of Texas CPA Certificate online? Why people would like to buy a realistic State of Texas CPA Certificate online? Which site is best to buy a realistic State of Texas CPA Certificate online? The best way to buy a realistic State of Texas CPA Certificate online? How much for fake State of Texas CPA Certificate online? Obtain fake State of Texas CPA Certificate online.

In the United States, Certified Public Accountant (CPA) certification is granted by individual states rather than by a national organization. Each state has its own Board of Accountancy that sets the requirements for CPA licensure, which typically include education, examination, and experience components. Can l purchase a realistic State of Texas CPA Certificate online?

For the State of Texas, the Texas State Board of Public Accountancy (TSBPA) is the entity responsible for the issuance of CPA certificates. To earn a CPA certificate in Texas, candidates must meet the following general requirements:

1. **Education**: Candidates must have a bachelor’s degree or higher from an accredited institution and complete 150 semester hours of college coursework, including specific accounting and business-related courses.

2. **Uniform CPA Examination**: Candidates must pass all four parts of the American Institute of Certified Public Accountants (AICPA) Uniform CPA Examination, which assesses knowledge and skills in areas such as auditing and attestation, business environment and concepts, financial accounting and reporting, and regulation.

3. **Ethics**: Texas requires candidates to pass an ethics course approved by the TSBPA. Buy fake degree in the USA, # buy diploma in America. Get Bachelor degree online, obtain a fake American College degree. How to buy a fake degree from the USA. Where to get a fake certificate in the US.

4. **Experience**: Candidates must also fulfill a work experience requirement, which typically involves one year (2000 hours) of work in accounting under the supervision of a licensed CPA.

Once these requirements are met, candidates can apply for their CPA certificate. After obtaining the CPA certificate, individuals must also apply for a license to practice. This usually involves additional steps, such as undergoing a criminal background check and meeting continuing professional education (CPE) requirements.

It’s important to note that the requirements for CPA licensure can change, and there may be additional stipulations or variations in the process. Therefore, it’s always best for candidates to refer to the TSBPA or the relevant state board for the most current information and detailed requirements.

If you are considering becoming a CPA in Texas or any other state, it is advisable to review the specific requirements as outlined by the state’s Board of Accountancy or consult with a professional in the field for guidance.